In today’s fast paced digital world, user-friendly digital payment methods have become more than just a convenience, they’re fundamental to building trust, loyalty, and satisfaction among users. Enter CHIP, a modern user centric digital payment solution designed to make transactions smoother, simpler, and smarter for businesses and consumers alike. Whether you’re running a café, an online store, or organizing group collections, CHIP brings payments into the next generation, user friendly, reliable, and utterly intuitive.

1. The New Era of Digital Payments

Gone are the days of carrying wads of cash or fumbling with inconvenient payment terminals. Modern consumers, especially millennials and Gen Z, expect experiences that are fast, frictionless, and mobile first. They want to tap, click, pay, and go. Businesses, in turn, need systems that adapt to this demand, integrate cleanly with their workflows, and handle all payment tasks without hiccups.

Key expectations:

- Simplicity – No confusing steps or long forms

- Speed – Payment processes should feel instantaneous

- Security – Users need confidence that their data is safe

- Flexibility – Accommodating different devices and preferences

- Transparency – Clear charges and full control of financial details

CHIP delivers on all of these fronts and more.

2. What Makes CHIP User-Friendly

2.1 Streamlined User Interface

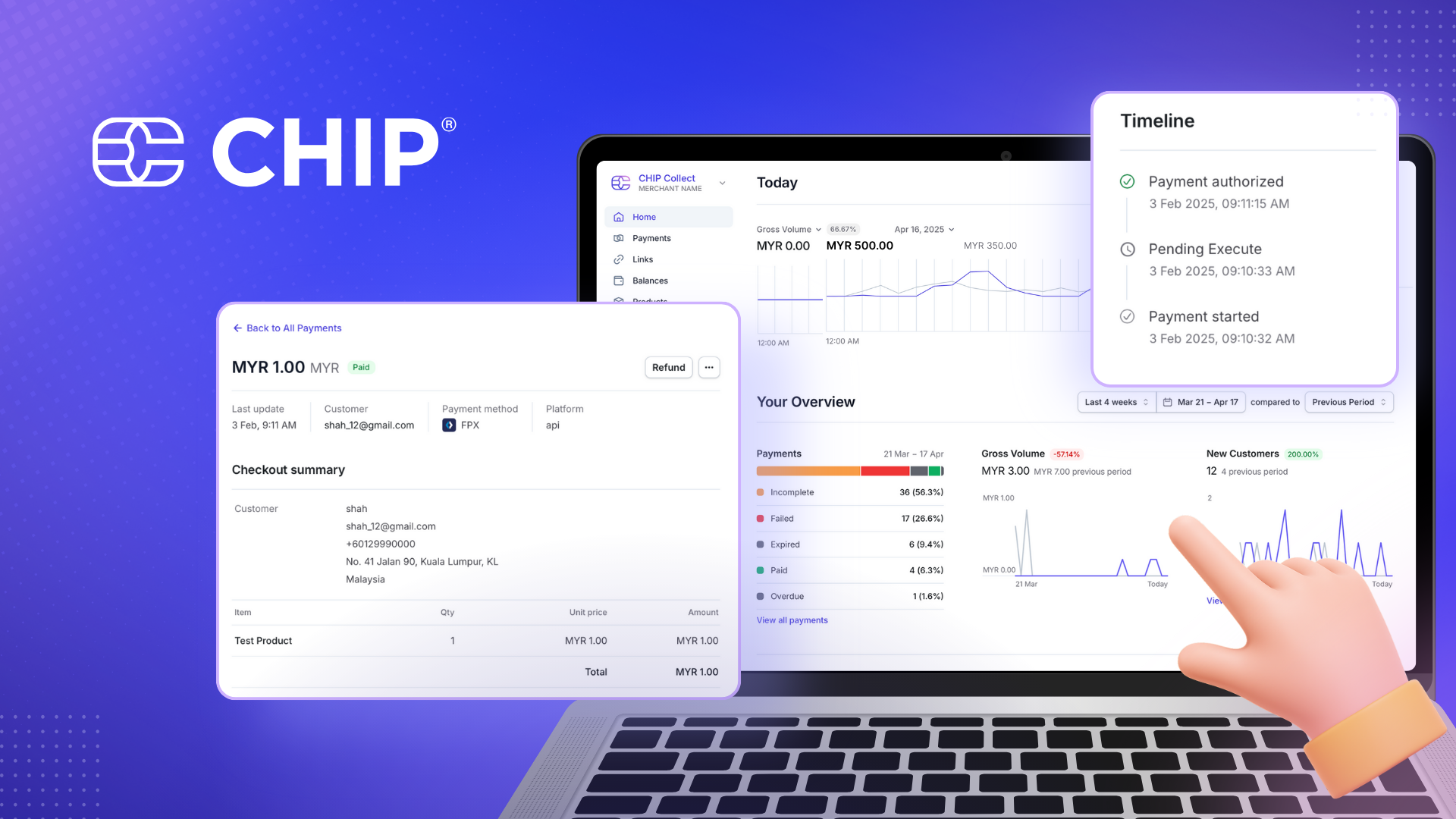

CHIP’s point of sale interfaces are designed with a focus on clarity and minimalism. Whether your customer is tech savvy or less digitally inclined, they can intuitively navigate each step, scan a QR code, or complete a payment, all in just a few taps.

2.2 One Tap Payments via payment methods

CHIP supports multiple payment modes: FPX, credit card, debit card, eWallet, DuitNow QR online, and BuyNowPayLater. These payment methods can be activated via easy API integration, plugins, or payment links. For quick checkouts, simply checkout and authorize the payment, and the transaction is complete. No extra hardware, no long queues.

2.3 Flexible Payment Modes

Whether it’s a one-off purchase or recurring subscription, CHIP supports it. Merchants can set up recurring payments for services like gym memberships, while consumer to consumer features allow friends and family to CHIP easily via their smartphones.

3. Built with Security and Compliance as Priorities

Security may seem invisible but it’s foundational.

- PCI DSS Compliance: CHIP meets top industry standards for handling card and digital payments.

- Tokenization and Encryption: Sensitive data is never exposed, reducing the risk of breaches.

- Fraud Monitoring: AI driven tools detect and prevent suspicious activity in real time.

This robust setup ensures peace of mind for both individuals and businesses.

4. Ideal Use Cases for CHIP

Let’s explore practical scenarios where CHIP shines.

4.1 Coffee Shops and Quick Service Retail

Imagine a bustling café: customers order, scan the menu’s QR code, pay instantly, and staff prepare the order, no waiting, no miscommunications, no hassle. CHIP’s seamless flow means faster table turns, happier customers, and less clutter at the counter.

4.2 Event Tickets and Group Collections

Hosting an event? Sell tickets, accept group contributions, and collect funds for pooled gifts, all entirely through CHIP. Friends can chip in their share, and you receive one consolidated payment, simplifying logistics and tracking for host and participant.

4.3 E-Commerce Launches and Online Checkout

Integrated into your online store, CHIP lets customers complete their purchase with a touch or click. This friction-free, mobile friendly checkout raises conversion rates and reduces cart abandonment. With support for regional eWallets and online banking, cross border sales become effortless.

5. CHIP for the Merchant: Setup and Integration

Merchants often worry about upfront effort, hardware, software, and training. CHIP drops that barrier.

- Simple Web and Mobile Onboarding

Sign up via the CHIP website, provide basic business details, and complete required compliance steps, all within minutes. - No Special Hardware

QR code-based payments eliminate the need for traditional card terminals. Smartphones or tablets are all that’s required to accept payments. - Smart Developer Integrations

CHIP offers APIs and plugins for major platforms like WooCommerce and other WordPress plugins. - Dashboard and Analytics

Merchants gain instant access to sales reports, customer patterns, and payout management tools. Understand what’s selling, when, and to whom with data that drives strategy.

6. Benefits for Consumers and Merchants

For Consumers:

- Speed and convenience

- Control over spending and receipts

- Robust data security

- Compatibility with all modern payment options

For Merchants:

- Boosted sales and loyalty

- Lower operational costs

- Data insights for smarter decisions

- Uniformed experience online and offline

7. Why CHIP Stands Out

Although several digital payment platforms operate within Malaysia, CHIP offers unique advantages such as:

- Unified system and developer friendly

- Built for community and group collections

- Clear transparent pricing

- Local compliance

8. Getting Started with CHIP

Curious? Getting started is easy. Head to CHIP’s website for details and sign up

Visit CHIP

On the site, you’ll find:

- A clear breakdown of pricing

- Tutorials for integration

- API guides and resources

9. Conclusion

At its core, CHIP delivers on what digital payment should be, fast, secure, flexible, and user-centric. Whether you’re buying a coffee, running an online store, or collecting group funds, it makes payments friction free and easy. It’s more than just a method, it’s a platform for better interactions, smarter decisions, and more engaging experiences start your journey today by visiting CHIP.