You might know that SSM introduced a new registration number format some time ago.

But, are you aware that SSM also updated the statutory documents for SDN. BHD.?

Some people might’ve only heard about Form 9, Form 24, or Form 49. But the updated SSM statutory documents will no longer use the ‘Form’ or ‘F’ code.

Instead, the updated versioning uses ‘Section’ or ‘S’ as the naming code.

The importance of SSM Statutory Documents

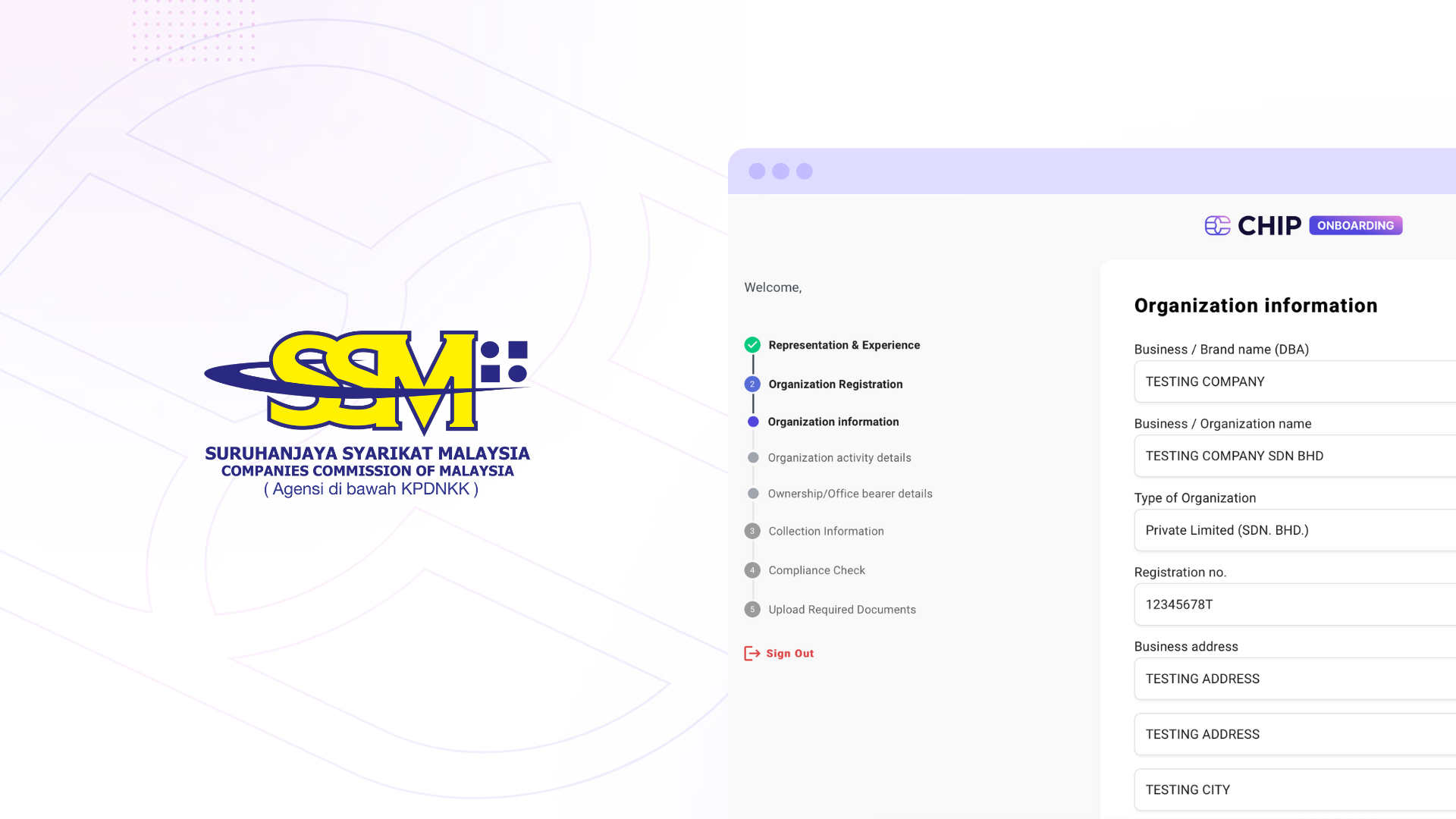

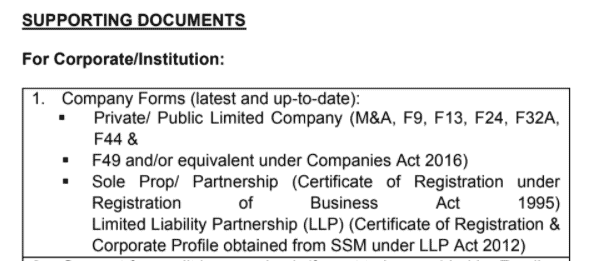

You need to provide specific statutory documents when opening your company bank account, applying for business loans, or becoming a merchant of payment gateways, including CHIP.

This requirement is a part of the Know-Your-Business (KYB) process, in line with the regulations set by the Bank Negara Malaysia and other regulators.

Below are some of the updated essential statutory documents that you should know:

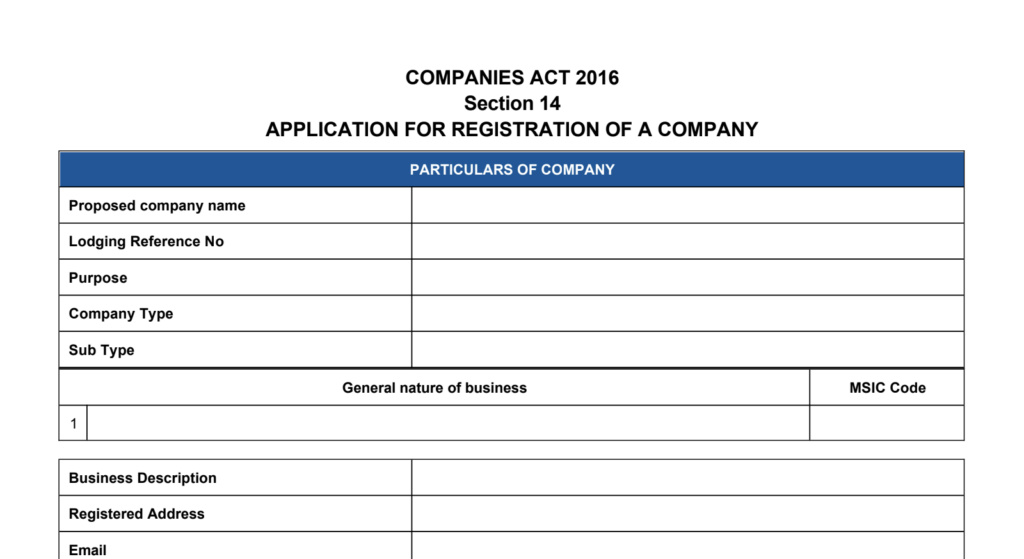

1. Application for Registration (Superform) – S14

Known as Form 24, Form 44, and Form 49.

The SSM will issue the Application for Registration (Section 14 or S14), commonly known as Superform, once a SDN. BHD. is incorporated.

This document contains the information submitted to SSM during the application process, such as:

- Company name & type

- Business nature & description

- Particulars of directors and shareholders

- The details of the person in charge who submitted the application

The S14 is not amendable. You need to submit additional documents if there is any update or change to your company’s information.

2. Certificate of Incorporation – S17

Known as Form 9.

The SSM will not issue the Certificate of Incorporation (S17) automatically. By default, the SSM will email the Notice of Registration (S15) only.

If you need this document, you can purchase and download it from MYDATA or SSM e-Info.

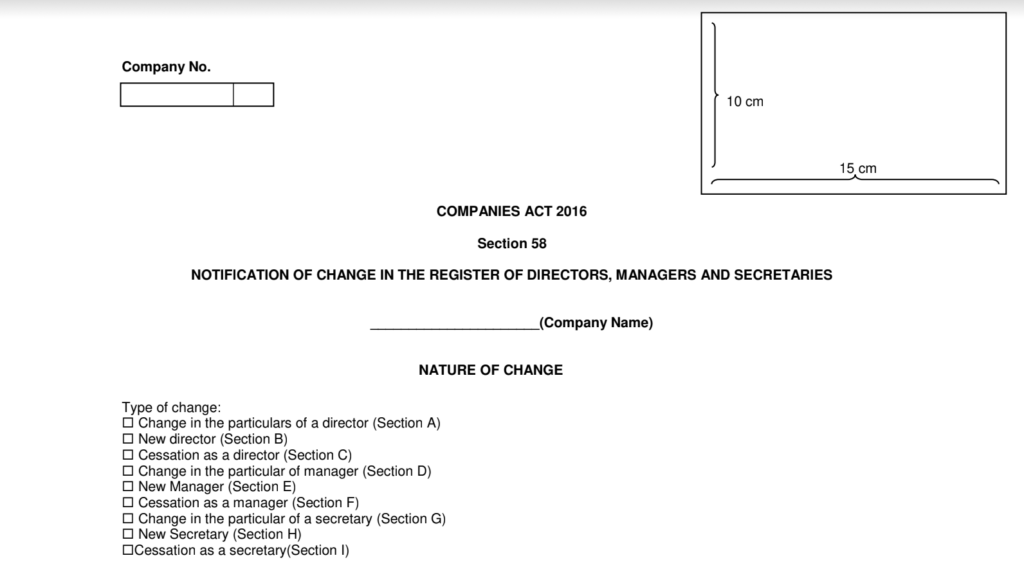

3. Notification of Change in the Register of Directors, Managers and Secretaries – S58

Known as Form 49.

Since the S14 is not amendable, your company secretary needs to submit the Notification of Change in the Register of Directors, Managers and Secretaries (Section 58 or S58) to the SSM whenever there are changes in the management of your SDN. BHD.

If you do have the S58, you should submit it together with the S14 even though the bank or the payment gateway is requesting the S14 only.

List of SSM Statutory Documents comparison

| Document Name | Companies Act 2016 | Companies Act 1965 |

| Superform | S14 | Details of Form 24, 44, 49 |

| Notice of Registration | S15 | N/A |

| Certificate of Incorporation | S17 | Form 9 |

| Declaration by the Directors | S201 | Form 48A |

| Notification of Appointment of First Company Secretary | S58 & 236(2) | Details of Form 49 |

| Constitution | S32 | M&A |

| Change in the Register of Members | S51 | Details of Form 24 |

| Instrument of Transfer of Shares | S105 | Form 32A |

| Return for Allotment of Shares | S78 | Form 24 |

| Notification of Change in the Register of Directors, Managers, and Secretaries | S58 | Form 49 |

Original article:

We’re always open to content contributions from our community. Join our Facebook Group and share your work or topic ideas to potentially be featured on our blog.

Moreover, if you have suggestions for our upcoming features, we’d love to hear them! Share your Wishlist with us.

Don’t forget to like and follow us on our social media platforms if you haven’t yet. You can find us on Facebook, Twitter, Instagram, and LinkedIn. We appreciate your support! 🙂